new mexico gross receipts tax changes

It varies because the total rate combines rates imposed by the state counties and if applicable municipalities where the businesses are located. Michelle Lujan Grisham signed House Bill HB 6 enacting major changes in the states corporate income tax and gross receipts tax GRT regimes.

1 Effective July 1 2021 the new law revises and expands recently enacted destination-based sourcing rules with respect to the gross receipts tax.

. The changes to the GRT came primarily in response to the US. Taxation and Revenue New Mexico. This would be the first change in the statewide gross receipts tax rate since July of 2010 when the rate increased from 5 percent to its current 5125 percent.

Some of these changes impact the work of Signed Language Interpreters. Changes Coming to Combined Reporting System. On April 4 2019 New Mexico Gov.

In addition compensating tax is now imposed on the privilege of using services in New Mexico. On April 4 New Mexico enacted significant corporate income and gross receiptscompensating tax changes. Tax Changes Start July 1.

6 of the 2019 legislative session sales and leases of tangible personal property in New Mexico will be subject to local tax at. Taxation and Revenue New Mexico. The sourcing for New Mexico changes from Origin-based sourcing to Destination-based sourcing with a few exceptions Effective July 1 2021 most businesses will collect the Gross Receipts Tax based on the rate where their goods or products of their services are delivered.

This means there will no longer be a difference in rates between the two taxes. The so -called destination sourcing method was mandated by legislation adopted in 2019. Back-to-School Tax Holiday is this weekend.

Taxation and Revenue New. New Mexico Register. Supreme Court decision in South Dakota v.

Michelle Lujan Grisham signed legislation amending certain provisions of the New Mexico gross receipts tax. Posted on June 21 2021 by Admin. 033121 Payment deadlines approaching for 2020 tax relief.

Fill Print Go. The New Mexico Taxation and Revenue Department TRD and the New Mexico Economic Development Department EDD will hold a webinar on Wednesday June 23 to assist businesses with transitioning to the new source-based gross receipts tax system and revised reporting website. Effective july 1 2021 new mexico changed gross receipts tax grt regulations to destination sourcing which requires most businesses to calculate and report grt based on where their goods or the product of their services are delivered.

New 35411 NMAC- Taxable in Another State When a Taxpayer is Subject to a Tax for Tax Periods Beginning on or After. Prior to July 1 New Mexico used origin-based sourcing in which most GRT was reported at the sellers place of business. Property Tax Division.

032321 Department begins issuing special 600 rebates. Pursuant to House Bill No. 032521 Hearing scheduled April 29 on new Gross Receipts Tax regulations.

35410 NMAC Taxable in Another State When a State has Jurisdiction to Subject a Taxpayer to a Net Income Tax. Most New Mexico -based businesses starting July 1 must now also use destination sourcing. On March 9 2020 New Mexico Gov.

Several changes to the New Mexico Tax Code regarding Gross Receipts Tax GRT went into effect on July 1 2021. Retailers whose sales are wholly or primarily at their place of business will see little or no effect. This would be the first change in New Mexicos gross receipts tax rate since.

032321 Appointments available at MVD due to expanded. Last week the New Mexico Department of Revenue issued a news release reminding taxpayers of big changes to gross receipts tax collection and reporting coming in July. 3549 NMAC Taxable in Another State When a Taxpayer is Subject To a Tax.

Changes Coming to Combined Reporting System. The so -called destination sourcing method was mandated by legislation adopted in 2019 and 2020. Gross Receipts Tax Changes.

Effective July 1 2021 New Mexico changed Gross Receipts Tax GRT regulations to destination sourcing which requires most businesses to calculate and report GRT based on where their goods or the product of their services are delivered. The governors initiative will comprise a statewide 025 percent reduction in the gross receipts tax rate lowering the statewide rate to 4875 percent. Hearing Thursday on new Gross Receipts Tax regulations.

Effective July 1 2021 local option compensation tax is now imposed at the same rate as local option gross receipts tax. The legislation also expands the gross receipts tax deduction for. Under the new rules most New Mexico-based businesses pay the Gross Receipts Tax rate in effect where their goods or the products of their services are delivered.

Notably for corporate income tax purposes the state adopted mandatory unitary combined reporting market-based sourcing for sales of other than tangible personal property and subtraction modifications for subpart F income and GILTI. The proposal would trim new mexicos gross receipts tax rate by 025 putting the rate at under 5. The initiative announced by Lujan Grisham comprises a 025 reduction in the statewide gross receipts tax rate reducing the statewide rate to 4875.

1 those businesses will pay both the statewide rate and local-option Gross Receipts Taxes. Clarify and update New Mexico tax code Many changes intended to prevent disputes add fairness. Remote sellers will now pay both the statewide rate and local-option Gross Receipts.

Restaurants bars breweries and other food service-related businesses in New Mexico have new guidelines in order to claim a Gross. According to the Taxation and Revenue Department New. In addition House Bill 163 cuts the states gross receipts tax rate by an eighth of a percent starting July 1 2022 and ramps up to a quarter-percent reduction on July 1 2023 saving New Mexico businesses and consumers nearly 200 million when fully implemented.

Gross Receipts Tax Changes 1. Under the new rules most New Mexico-based businesses pay the Gross Receipts Tax rate in effect where t heir goods or the products of their services are delivered. The Gross Receipts Tax rate varies throughout the state from 5125 to 94375.

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

What You Should Know About Changes To Nm Tax Reporting Youtube

Revenue Windfall Could Prompt Tax Cut Talks Albuquerque Journal

A Guide To New Mexico S Tax System New Mexico Voices For Children

Nm Grt Tax Rate Schedule Updated For January 2020 Gaar Blog Greater Albuquerque Association Of Realtors

News Alerts Taxation And Revenue New Mexico

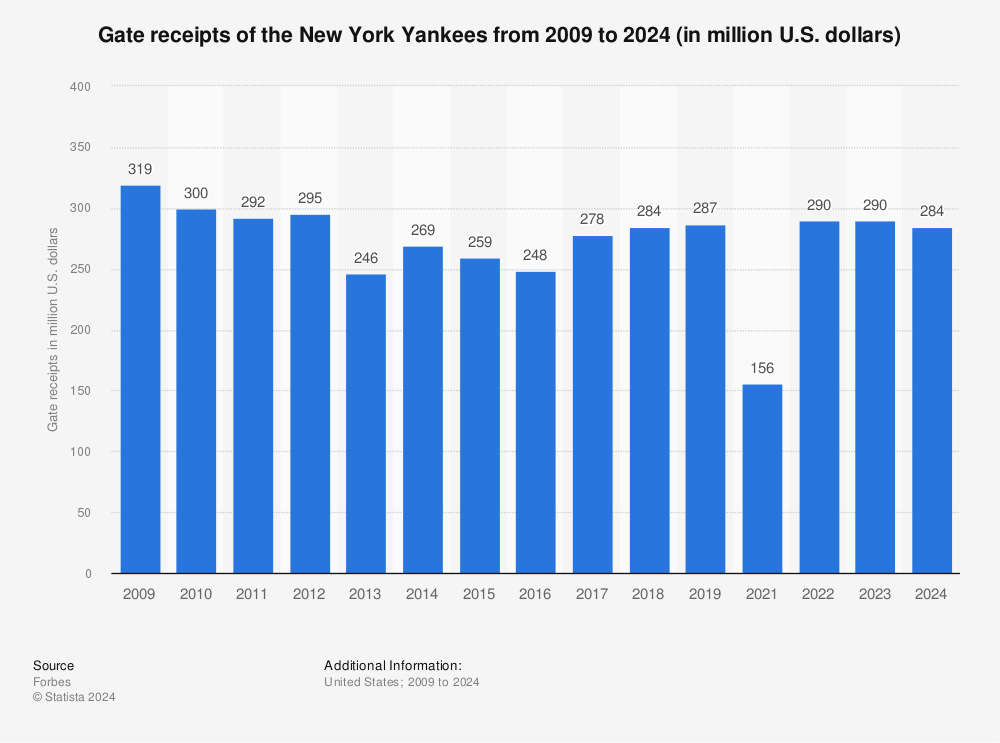

New York Yankees Gate Receipts Ticketing 2021 Statista

Tax Rates Climb Amid Debate Over Revising State Code Albuquerque Journal

A Guide To New Mexico S Tax System New Mexico Voices For Children

A Guide To New Mexico S Tax System Executive Summary New Mexico Voices For Children

Gross Receipts Location Code And Tax Rate Map Governments

Reporting Locations And Claiming Deductions For Gross Receipts Tax Youtube

Nm Grt Tax Rate Schedule Updated For January 2020 Gaar Blog Greater Albuquerque Association Of Realtors

Nm Grt Tax Rate Schedule Updated For January 2020 Gaar Blog Greater Albuquerque Association Of Realtors

New Mexico Tax Law Unintentionally Cuts Into City Revenues Kob 4